What Is Life Insurance?

Life insurance is like a safety net for your loved ones. It’s a contract between you and an insurance company. You pay regular amounts of money, called premiums, and in return, the company promises to pay a lump sum of money, called a death benefit, to your beneficiaries when you pass away. This helps ensure that your family can manage financially during a tough time.

Why Do You Need Life Insurance?

Imagine your family without your income. How would they pay the bills or maintain their lifestyle? Life insurance can help. It provides financial security, covering debts like a mortgage, and can fund your children’s education. It’s a way to show you care about their future, even when you’re not there.

How Does Life Insurance Work?

Life insurance works simply. You choose a policy that suits your needs and budget. After you apply, the insurer assesses your health and lifestyle. Depending on that assessment, they offer you a premium that you’ll need to pay regularly—monthly or yearly.

When you pass away, the insurance company pays the agreed amount to the person you’ve named as your beneficiary. The best part? This money is typically tax-free. This helps your loved ones with immediate expenses and long-term financial goals.

Types of Life Insurance

Term Life Insurance

Term life insurance is like renting an apartment. You pay a monthly amount for a specific period—usually 10, 20, or 30 years. If you die during that term, your beneficiaries get the payout. But if you outlive the term, your coverage ends, and you get nothing back. This type is often cheaper and ideal for young families.

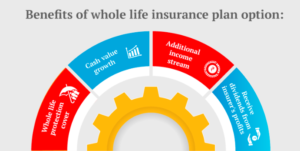

Whole Life Insurance

Whole life insurance is more like buying a house. You pay premiums for your entire life, and it builds cash value over time. This means you can borrow against it or withdraw money if needed. It’s more expensive but offers lifelong protection and a savings component.

Universal Life Insurance

Universal life insurance is flexible. You can adjust your premiums and death benefit as your life changes. It combines the benefits of whole life insurance with flexible payment options. This can be a great fit for those who want more control over their policy.

Choosing the Right Policy

Choosing the right life insurance policy can feel overwhelming. It’s important to consider your financial goals, how much coverage you need, and your budget. Think about what would help your family the most if you were no longer there. A good step is to write down your current expenses and future goals to guide your decision.

The Application Process

Applying for life insurance is simple but requires some thoughtful steps. You’ll fill out a questionnaire about your health and lifestyle, and sometimes, you may need to undergo a medical exam. The insurer will review this information and determine your premium. It may take a few weeks to get approved, but once you’re in, you’re secured.

Final Thoughts

Life insurance isn’t just a policy; it’s peace of mind. It’s about protecting those you love from financial hardship when the unexpected happens. It’s like planting a tree today for the shade it will provide tomorrow. Evaluate your options wisely, and take that step towards ensuring your family’s future.